WHAT ARE YOU LOOKING FOR?

Popular Tags

Press Release

2Q 2022 GDP Growth At 8.9%: Government Policies To Restore And Stimulate The Economy Impactful And Effective

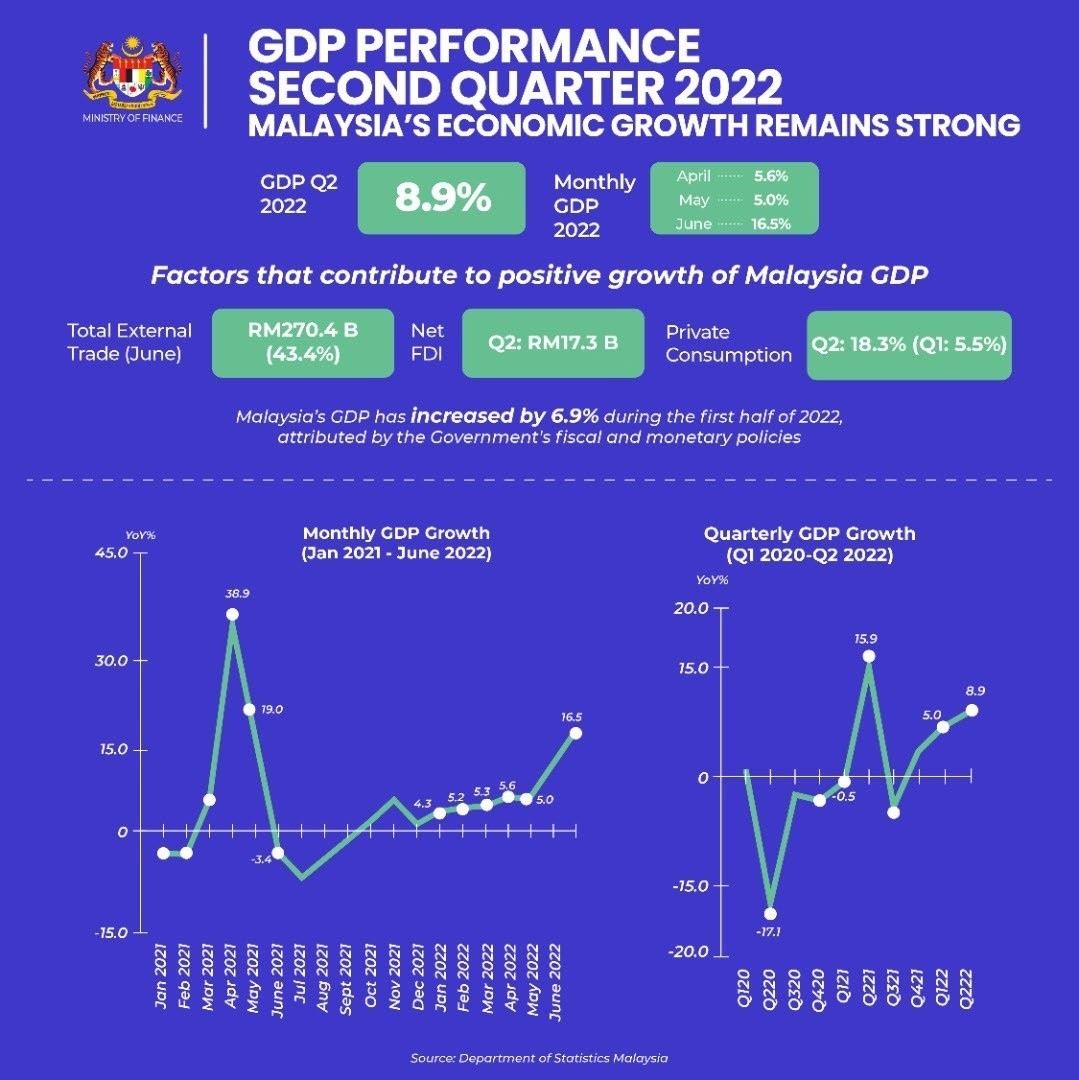

Malaysia's economy continued its recovery momentum, with its Gross Domestic Product (GDP) for the second quarter of 2022 (Q2 2022) growing by 8.9%, exceeding the 5.0% recorded in the first quarter of 2022 (Q1 2022) and outperforming the economic performance of several developed and regional countries (China: 0.4%, USA: 1.6%, EU: 4.0%, Korea: 2.9%, Singapore: 4.4%, Indonesia: 5.4%, Philippines: 7.4%). With the Q2 2022 growth achievement, GDP for the first half of 2022 is 6.9%, suggesting an equally strong third quarter growth. As such, the Government is confident the Malaysian economy can achieve the official 2022 GDP projection of 5.3% to 6.3%.

This encouraging development in Q2 2022 was attributable to, among others, an expansionary fiscal policy through Budget 2022, positive spill over from the assistance and economic stimulus packages and Budget 20212, as well as a monetary policy which remained accommodative. Coupled with the full reopening of the economy and international borders, it resulted in 18.3% growth in private consumption (compared to 5.5% in Q1 2022), which is the main contributor to GDP. Growth in Q2 2022 was also supported by the labour market's continued recovery and increased domestic and foreign demand, particularly in the services and manufacturing sectors.

Throughout Q2 2022, monthly GDP increased for the months of April (5.6%), May (5.0%), and June (16.5%). Among the economic indicators that demonstrated growth trends include the following:

- The unemployment rate decreased to 3.8% in June 2022, the lowest level since COVID-19 hit the country, with a total of 630,000 unemployed, compared to the peak of 826,000 in May 2020. The downward trend in the unemployment rate is expected to continue in the coming months, supported by the economy's full opening and ongoing Budget 2022 policies such as the RM4.8 billion JaminKerja job creation initiative, as well as wage subsidy programmes for the retail and tourism sectors. In terms of benefitting employees, this has increased salaries and wages by 5.2% in the manufacturing sector and 9.3% in the services sector in Q2 2022.

- Demand from households and businesses continued to be encouraging, with wholesale and retail trade sales increasing by 44.0% to RM132.8 billion in June 2022. This positive growth was contributed by various sub-sectors including motor vehicle sales (1,642.8%), retail trade (38.4%), and wholesale trade (19.3%). The services sector recorded a total revenue of RM506.5 billion in Q2 2022, representing a 25.2% growth. The Wholesale & Retail, Food & Beverage, and Lodging segments contributed to this increase.

- The Industrial Production Index (IPI) which increased by 12.1% in June 2022, supported by the manufacturing, electric and mining sectors. At the same time, sales in the manufacturing sector increased by 23.4% to more than RM153 billion, led by the electrical and electronic equipment manufacturing subsector.

- External trade increased 43.4% to RM270.4 billion in June, registering double-digit growth for 17 consecutive months since February 2021. Exports totalled RM146.2 billion (+38.8%), recording growth for 22 consecutive months since September 2020. Imports increased by 49.3% to RM124.2 billion. Total external trade increased by 28.2% in the first half of 2022, totalling RM1.36 trillion. This is the highest half-year value for trade, exports, imports, and trade surplus ever recorded.

- Net foreign direct investment (FDI) has remained positive, totalling RM17.3 billion. The manufacturing sector, financial activities and insurance/takaful, as well as wholesale and retail trade, have attracted the majority of FDI inflows, primarily from the United States (US) and Singapore.

- Inflation remained stable at 2.5% in the first six months of this year, and recorded a rate of 3.4% in June 2022. With the implementation of price control measures, particularly the provision of consumer subsidies worth RM80 billion this year, Malaysia's inflation rate remains under control and is significantly lower than that of Australia and Singapore (over 6%), Thailand (over 7%), and the United States and the United Kingdom (over 9%).

For the Malaysian capital and financial markets,

- The banking system continues to remain strong and facilitates credit intermediation in the economy. Net financing increased by 5.0% in June this year (May 2022: 4.5%), with household loans increasing by 5.9% (May 2022: 5.0%) and business loans increasing by 5.8% (May 2022: 5.4%). Higher loan growth reflects stronger growth in the wholesale and retail trade, transportation, storage, and communications sectors.

- The FBM KLCI index continues to draw retail and foreign investors. The latest net inflow of foreign funds totalled RM6.9 billion since the beginning of the year, while retail investors recorded net purchases totalling RM1.6 billion.

- As of July 29, 2022, Bank Negara Malaysia's (BNM) international reserves stood at USD109.2 billion (RM487 billion). This amount is enough to cover 5.8 months of goods and services imports, as well as 1.1 times the total short-term foreign debt.

MOVING FORWARD

Following the country's transition to the Endemic Phase and the opening of international borders, Malaysia's economic growth is expected to be supported by more vigorous economic and social activities, as well as strong domestic and foreign demand. Economic growth momentum is expected to remain strong in Q3 2022, driven by encouraging performance in foreign trade and tourism.

Nonetheless, the Government remains cautious for the second half of 2022, when the economic outlook is still subjected to risks of slower growth due to global economic uncertainty caused primarily by the prolonged Russia-Ukraine conflict, as well as China's economic slowdown following the implementation of strict COVID-19 containment measures. These risks have resulted in the International Monetary Fund’s (IMF) revision of its global growth forecast for 2022 from 3.6% to 3.2%. Furthermore, higher inflationary pressures due to expected increases in commodity and food prices, as well as ongoing global supply chain disruptions, are factors that may impact global growth.

The Ministry of Finance is currently preparing the Budget 2023 through consultations and engagements with various economic sectors and states to ensure that the budget benefits the whole of Keluarga Malaysia. Among the priorities include more sustainable subsidy management, economic reforms, and strengthening the country's resilience to future shocks. Following the serious challenges of geopolitical uncertainty and climate change, initiatives related to sustainability will also be considered more broadly.

Along with the post-COVID-19 economic recovery momentum, Budget 2023 will continue to prioritise the people's welfare, particularly in terms of improving income and social protection. Economic reform efforts will also be prioritised to ensure long-term growth as well as increased competitiveness in business and value chains.

Moving forward, the Government and its related agencies will continue to monitor the progress of various economic risks and ensure the effectiveness of policy decisions in managing external shocks that could negatively impact citizens' and businesses' well-being.

YB Senator Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz

Minister of Finance

12 August 2022

APPENDIX