WHAT ARE YOU LOOKING FOR?

Popular Tags

Press Release

Pre-Budget Statement 2026

1. INTRODUCTION

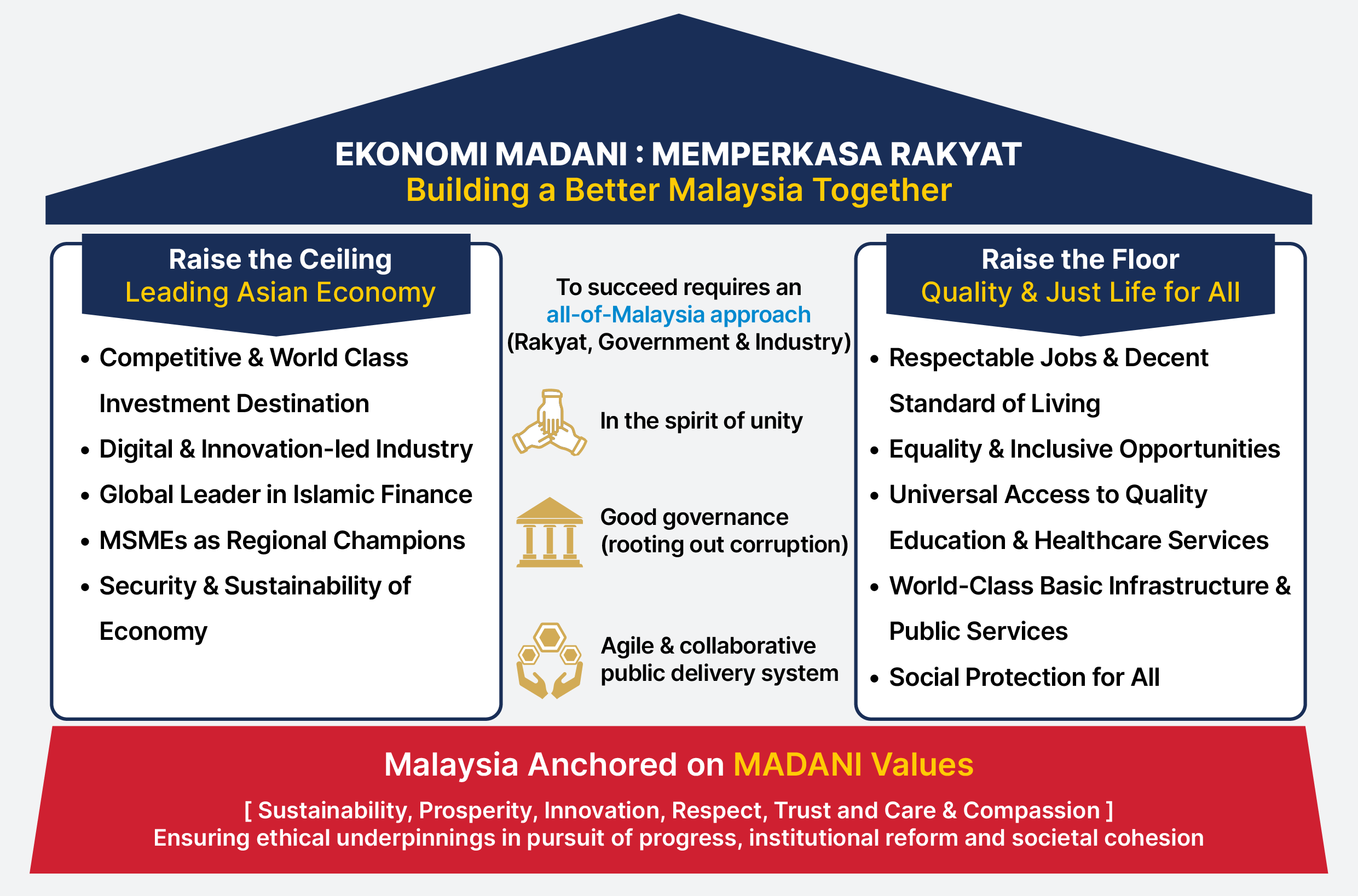

Budget 2026 will be the fourth in the series of MADANI Budget, designed to advance the vision of Ekonomi MADANI: restoring fiscal resilience, strengthening economic foundations and uplifting the dignity and livelihoods of the rakyat. As with its predecessors, Budget 2026 will continue to deliver on the three pillars of Ekonomi MADANI — Raising the Ceiling of national growth, Raising the Floor of living standards and Driving Reform, particularly in Good Governance. The Ekonomi MADANI Framework with its three guiding pillars is illustrated as below:

Ekonomi MADANI : Memperkasa Rakyat – Building a Better Malaysia Together | Muat turun ⬇️

With earlier MADANI Budgets already laying strong foundations, Budget 2026 aims to build on this momentum. It also marks the first Budget under the 13th Malaysia Plan (13MP) 2026–2030 and reaffirms three pillars of the Ekonomi MADANI.

Against a global backdrop driven by uncertainties and intensifying competition, Budget 2026 will remain focused on delivering Malaysia’s longer term economic reform agenda, while addressing short term challenges to maintain the momentum of growth and safeguard the resilience of the economy. At the same time, efforts will be undertaken to enhance the well-being of the rakyat through more targeted and outcome-driven assistance towards improving quality of life.

2. ECONOMIC AND FISCAL POSITION 2025

Malaysia’s economy continued to demonstrate resilience in the face of heightened global trade tensions. Gross Domestic Product (GDP) in the first quarter of 2025 expanded 4.4%, driven by household consumption, investment and the construction sector. The momentum is expected to continue in the second quarter of 2025, with advance estimate indicating growth at 4.5%. Despite global developments, the Malaysian economy remained resilient — and is projected to expand by 4% to 4.8% in 2025.

Inflation abated further to 1.1% in June 2025 from 1.8% in the previous year, marking the lowest pace in 52 months. The implementation of reform measures such as the expansion of Sales and Service Tax (SST), minimum wage increases and subsidy targeting rationalisation has not unduly affected inflation, which is expected to remain modest in 2025 at between 1.5% to 2.3%.

Malaysia’s labour market continued to strengthen, with the national unemployment rate declining to 3.0% in May 2025 — down from 3.3% in May 2024. This marked the second consecutive month in which the unemployment level matched its lowest level since April 2015, reflecting continued momentum in job creation and economic recovery. The number of unemployed persons declined by 5.7% year-on-year to 522,400 in May 2025, compared to 554,100 in the same month last year.

The Government remains committed to fiscal consolidation and continues to target narrowing the fiscal deficit to 3.8% in 2025, from 4.1% in the preceding year — resuming the gradual consolidation from 5.0% in 2023 and 5.5% in 2022. The fiscal consolidation is supported by the implementation of Budget 2025 measures including expansion of revenue base as well as optimising expenditure, such as through the shift from blanket subsidies to more targeted subsidies. Fiscal space generated has enabled funds to be reallocated towards improving social assistance as well as healthcare, education and transportation.

Along with the deficit reduction, the Government has reduced annual debt issuance. The Federal Government’s new debt eased from RM99.4 billion in 2022 to RM92.6 billion in 2023. The downward trajectory continued in 2024, with new debt amounting to RM76.8 billion. This continuing resolve for fiscal consolidation is enshrined in the Public Finance and Fiscal Responsibility Act (FRA; Act 850), which stipulates that fiscal deficit to be capped at 3% or lower and debt level to not exceed 60% of GDP in the medium term.

The ringgit emerged as one of Asia’s best-performing currencies as at 6 August 2025, appreciating 5.8% to RM4.2270 against the US dollar. Despite a challenging global environment, demand for the ringgit remains supported by strong economic fundamentals and investor confidence.

Key Achievements to Date

The outcomes of strategic initiatives introduced have shown significant results, including:

- Approved Investments: Malaysia secured RM384.4 billion in approved investments in 2024, marking the second straight year of record-breaking performance (2023; RM329.5 billion). The momentum carried into the first quarter of 2025, with approved investments growing 3.7% year-on-year to RM89.8 billion. The sustained investment momentum reflects strong investor confidence in Malaysia’s commitment to reforms under the Ekonomi MADANI framework.

- Sovereign Credit Rating: Malaysia's credit rating position is A3 by Moody’s Investor Service, A- by S&P Global Ratings and BBB+ by Fitch Ratings, all with a 'Stable' outlook. The key drivers of Malaysia's ratings include the country's diversified economy and resilient growth, a strong and stable banking system and low exposure of Federal Government debt to foreign exchange risk.

- Global Competitiveness: Malaysia made the biggest leap in the IMD World Competitiveness Ranking 2025, jumping 11 spots to 23rd out of 69 economies — its best showing since 2020, and the only country to record a double-digit improvement. Driven by a buoyant economy and improved governance across both public and private sectors, the Ekonomi MADANI framework aspires to position Malaysia among the world’s 12 most competitive economies by 2033.

- GEAR-uP: The Government-linked Enterprises Activation and Reform Programme (GEAR-uP), led by the Ministry of Finance, has mobilised RM11 billion in domestic direct investments (DDI) into high-growth, high-value (HGHV) sectors such as semiconductors and energy transition. This forms part of the RM25 billion pledged by six Government-linked Investment Companies (GLICs) under the programme. In parallel, 34 GLICs and their associated Government-linked Companies (GLCs) have committed to providing a minimum monthly living wage of RM3,100 — benefitting 153,000 workers — as part of a broader wage reform agenda to improve living standards.

- Targeted Subsidy and Social Protection: The Government’s pivot from blanket subsidies to a targeted model has delivered a dual benefit — enhancing fiscal sustainability while enhancing assistance to beneficiaries. Among others, allocation for Sumbangan Tunai Rahmah (STR) and Sumbangan Asas Rahmah (SARA) rose 30% year-on-year to RM15 billion, more than sevenfold since the Government’s direct cash transfer programme was first introduced in 2012. This includes a one-off disbursement of RM100 in SARA credit to all Malaysians aged 18 and above.

- Revenue-Enhancement Measures: To strengthen Malaysia’s fiscal resilience, the Government introduced several initiatives in 2025 to broaden the tax base, which stood at 12.4% of GDP in 2024. These include a targeted revision of the Sales Tax rate, the expansion of Service Tax to five additional service categories, continued rollout of e-Invoicing and the Tax Identification Number (TIN) and implementation of the Global Minimum Tax to ensure a fairer tax landscape for multinationals.

- Major Infrastructure Upgrades: The development of essential infrastructure continues to improve regional connectivity and local economic activities. Major projects nearing completion include the Light Rail Transit Line 3 (LRT3) and the Electric Train Service (ETS) extension to Johor Bahru. Other key initiatives include the East Coast Rail Link (ECRL), the RTS Link connecting Johor Bahru and Singapore, and the Juru–Sungai Dua Elevated Highway project. Healthcare access will be improved through the construction of Hospital Sultanah Aminah 2, while climate resilience is being strengthened via the Rancangan Tebatan Banjir (RTB) Kota Bharu project. In Sabah and Sarawak, priority remains on expanding access to roads such as the Pan Borneo Highway, clean water through the construction of Water Treatment Plant in Landeh, Sarawak and rural connectivity including the construction of Main Electricity Supply Substation in Paitan, Sabah to support more balanced development.

Malaysia’s economy is expected to grow at a moderate pace in 2026 amid heightened global trade uncertainties and subdued external demand. Growth will be anchored by resilient domestic demand — particularly through private investment, stable employment, and income-enhancing measures such as targeted cash transfers and wage increases. The tourism sector, driven by Visit Malaysia 2026, is also set to contribute significantly to services growth. In this context, Budget 2026 will prioritise strengthening domestic sources of growth, diversifying export markets, and expanding household income opportunities. Public investment will be advanced through strategic projects under the 13MP and increased DDI by Government-Linked Investment Companies (GLICs) through the GEAR-uP programme, reinforcing the foundations for inclusive and sustainable economic resilience.

3. KEY FOCUS AREAS OF BUDGET 2026

Next year’s focus will continue building on the three pillars of Ekonomi MADANI while simultaneously laying the groundwork for the first year under the 13MP. Budget 2026 will continue to advance the Ekonomi MADANI agenda through a bottom-up, people-centred approach that places the needs of communities at the heart of public policy. Programmes such as Sejati MADANI, Kampung Angkat MADANI and Sekolah Angkat MADANI reflect the Government’s commitment to empowering local communities by directing resources based on ground-level priorities. In formulating Budget 2026, the Government will further institutionalise this approach by actively soliciting feedback from the rakyat, businesses, and key stakeholders to ensure that national policies are

aligned with realities on the ground.

A) DRIVING REFORM & GOOD GOVERNANCE

Budget 2026 aspires to advance the public sector reform agenda – enhancing governance, strengthening service delivery, and safeguarding fiscal sustainability. To this end, the Government will prioritise the modernisation of public service delivery, introduce frameworks and legislation to strengthen civil service performance, and reinforce the principles of integrity and ethical governance. These reforms will be underpinned by a commitment to optimise public resources, minimise leakages, and ensure that assistance is effectively targeted to those most in need.

Strengthening Institutional Integrity and Fiscal Governance

To elevate national governance standards, Budget 2026 builds upon ongoing reforms under the FRA and National Anti-Corruption Strategy 2024–2028. These efforts are now being complemented by a suite of upcoming legislation — including the Government Procurement Act, State-Owned Enterprises Act, Ombudsman Act and Freedom of Information Act — aimed at reinforcing transparency, curbing leakages and restoring public trust.

The Malaysian Anti-Corruption Commission (MACC) continues to lead enforcement and cross-border asset recovery efforts, including in cybercrime and digital asset flows. Starting 2025, reforms in corporate governance — such as new audit exemption criteria for selected private companies — will further balance business compliance and good governance.

Modernising Public Finance through Technology

The Government is accelerating digitalisation across the public sector to optimise revenue collection, minimise leakages and improve programme delivery. This includes leveraging AI, big data analytics and automation to detect tax non-compliance — with agencies like LHDN using AI for more effective enforcement.

Advancing GovTech and Citizen Services

The Government is accelerating efforts to enhance service efficiency and accessibility through nationwide GovTech initiatives. Applications such as MyVisa 2.0 and MyJPJ, alongside digital one-stop centres, are reducing bureaucratic burden and enabling more seamless public transactions. These are underpinned by investments in digital infrastructure, data integration, and capacity building. While certain services and areas still require physical visits due to infrastructural or procedural constraints, the Government remains committed to overcoming these challenges through continued innovation and the expansion of GovTech solutions, ensuring that all Malaysians benefit from faster, more inclusive and citizen-centric services.

Civil Service Reform for a Future-Ready Government

Institutional renewal begins with civil service reform. Budget 2026 will drive performance-based evaluations, capacity-building and accountability measures under the Public Service Efficiency Commitment Act 2025 (Act 867). These efforts aim to create a civil service that is agile, digitally fluent and equipped to implement Ekonomi MADANI with integrity and speed. The Government also remains steadfast in improving the ease of doing business by streamlining regulations, simplifying business processes, and accelerating the digitalisation of government services to reduce red tape and enhance complete service delivery.

B) RAISING THE CEILING

“Raising the Ceiling” is one of the three central pillars of Ekonomi MADANI, aimed at propelling Malaysia towards a high-income, competitive and sustainable economy grounded in humanistic values and social justice. This pillar focuses on breaking through long-standing structural constraints — particularly the nation’s over-reliance on low- and medium-cost economic models. With Ekonomi MADANI setting the ambition for Malaysia to become one of the world’s top 12 most competitive economies, a fundamental transformation of our industrial base is indispensable. This includes elevating Malaysia’s position in global value chains and shifting towards higher productivity and innovation-driven growth.

Strategic Levers Driving Malaysia’s Industrial Transformation

At the heart of the “Raising the Ceiling” pillar is the imperative for Malaysia to capitalise on the next wave of industrial transformation. To kickstart this transition, the Government is prioritising investments in HGHV areas — covering new opportunities in frontier technologies and pathways anchored in sustainability. These include digital technology, advanced manufacturing, semiconductors, renewable energy and AI- driven services — sectors with strong long-term growth potential, the ability to buoy Malaysia’s export growth and the capacity to create high-skilled employment.

This economic repositioning is compassed by a suite of policy levers designed to liberalise key sectors and attract quality investments. Budget 2026 builds on the momentum of these initiatives and continues to accelerate their impact:

| Policy Lever | Strategic Focus | Key Milestones and Targets |

|---|---|---|

| New Industrial Master Plan 2030 (NIMP 2030) | Driving industrial transformation in manufacturing and related services, boosting productivity and innovation | 4.1% year-on-year growth in value-added output in the first quarter of 2025 (RM95.7 billion); 50,000 jobs from realised investments |

| National Energy Transition Roadmap (NETR) | Green growth; renewable energy; energy efficiency; carbon capture, utilisation and storage (CCUS) | RM60 billion investment potential; 84,000 jobs; Energy Efficiency and Conservation Act 2024 (Act 861) and CCUS Act 2025 to reduce 24,226 Gg of CO2 equivalent annually |

| National Semiconductor Strategy (NSS) | Positioning Malaysia in the global chip supply chain; R&D, design and high-end packaging | RM52 billion investments committed in the first quarter of 2025, with 23,000 potential jobs; R&D incentives and talent schemes launched |

| KL20 Action Plan | Making Malaysia a top 20 startup hub | Single Window registered startups rose to 4,464 year to- date (2024; 3,679); streamlining regulatory approvals |

| National AI Plan 2026-2030 | Embedding AI in economy and governance; positioning Malaysia as regional digital hub | Announced in line with 13MP; supports productivity, talent growth and high-quality FDI |

| Pelan Transformasi Ekonomi Bumiputera 2035 (PuTERA35) | Boosting Bumiputera participation in HGHV sectors | Target to expand Bumiputera share beyond 8% of GDP; shift to export-oriented industries |

| Government-linked Enterprises Activation and Reform Programme (GEAR-uP) | Mobilising GLICs and GLCs to boost high-growth, high- value industries while uplifting communities in need | RM120 billion DDI to be deployed across 2024 – 2028 (as of June 2025 RM11 billion deployed) and living wage commitments secured for 153,000 employees |

Tailoring Incentives to Solidify Malaysia’s Investment Proposition

To complement the nation’s industrial transformation, the Government will continue refining its suite of strategic investment incentives — with the New Investment Incentive Framework, slated for launch in the third quarter of 2025, to lead the way. The goal is to tailor incentives to the economic returns of each sector, fostering a mutually beneficial dynamic that attracts quality investments while ensuring meaningful national gains.

Budget 2026 will sharpen this approach by further streamlining approval processes, dismantling bureaucratic hurdles and realigning incentives to better reflect the complexity, value-add and technological intensity of targeted industries.

These reforms aim to transform Malaysia into a facilitative, competitive investment destination that rewards innovation, prioritises long-term sustainability and positions the country at the forefront of economic value creation.

Unlocking Cascade Effects Across the Economy

The strategic policy levers are designed to generate economic multipliers that cascade through the entire supply chain, building ecosystems that support HGHV sectors. These efforts aim to drive inclusive, broad-based growth and catalyse development across all economic corridors. Budget 2026 will continue cultivating these downstream ecosystems and accelerating regional development through the following focus areas:

- MSMEs and Digital Adoption: Supporting small businesses by easing access to export markets and financing their digital transition to improve productivity and competitiveness.

- Tourism and Services Growth: Leveraging Visit Malaysia 2026 to revitalise tourism and adjacent service sectors.

- Islamic Finance and Economy: Strengthening premium halal supply chains and cementing Malaysia’s global leadership by leveraging Islamic finance as a key enabler.

- Regional Development: Diversifying economic growth beyond established urban centres by developing catalytic nodes across states — replicating models such as the Johor-Singapore Special Economic Zone (JS-SEZ), Kulim Hi-Tech Park and Penang Silicon Island.

C) RAISING THE FLOOR OF RAKYAT’S LIVING STANDARDS

As Malaysia pushes towards a more complex, competitive economy, Budget 2026 builds on its predecessors’ efforts to lift the nation’s baseline and ensure that economic growth translates to better quality of life for the rakyat.

The “Raising the Floor” pillar is inextricably linked to the broader transformation agenda under “Raising the Ceiling.” National development cannot succeed without safeguarding our most valuable asset: human capital.

This pillar upholds the principles of a just economy — one that ensures security, dignity and equal opportunity for all. It focuses on delivering universal access to essential services, fair wages, robust safety nets and pathways for every Malaysian to move upward.

Labour Market Reform

In parallel, labour market reforms will focus on enhancing employability and access to higher-income opportunities. Beyond statutory minimum wage levels, efforts will centre on enabling sustainable wage growth to ensure improved living standards and long-term household resilience. This includes industry partnerships to support career progression, upskilling initiatives and reforming employment structures to support equitable growth. The Government also remains committed to responding to the dynamics of the evolving labour market.

Expanding Socioeconomic Assistance Mechanisms for a More Dignified Living

Under Budget 2026, the Government will continue providing socioeconomic assistance to better protect groups who are most vulnerable to cost-of-living pressures. This assistance is ultimately intended to provide income support to ensure that all segments of society can attain a dignified living, ensuring rakyat can afford basic necessities particularly foods and essential goods, while strengthening national food security. At the same time, efforts will focus on minimising inclusion and exclusion errors to ensure assistance is accurately targeted to those who need it most.

Complementing these efforts, the Government remains committed to transitioning from blanket subsidies to a targeted subsidy model to eliminate leakages, improve fiscal efficiency, and ensure that public resources are channelled to those who need them most and ensure that the majority of rakyat continues to benefit. It also reflects a more sustainable and equitable framework for subsidy reforms.

Taken together, improvements to these institutionalised platforms signal a stronger, more adaptive social protection system — one that uses data and automation to deliver support with greater accuracy, speed and dignity.

Towards a More Equitable and Sustainable Healthcare System

Budget 2026 aims to address key findings from the Joint Ministerial Committee on Private Healthcare Costs (JMCPHC), particularly on the rising cost of private healthcare. The healthcare reforms aim to strengthen medical security by ensuring affordable, equitable, and quality care. Focus areas include expanding protection for vulnerable groups, improving access to affordable medicines, enhancing rural primary care, digitalising services through telemedicine and electronic records, and boosting system readiness for future crises and an ageing population.

Reforming Education to Power an Inclusive, Future-Ready Economy

Inclusive education remains a central pillar of the Government’s reform agenda — as it remains the definite pathway toward upward mobility and a decisive break from generational poverty. Budget 2026 will operationalise the education reform agenda outlined in the 13MP, with a clear objective: to produce a talent pool capable of meeting the growing demands of Malaysia’s HGHV industries. These reforms will be spearheaded by the soon-to-be-established Majlis Pendidikan Negara, which will coordinate implementation across all levels of Government and education providers.

The Government also seeks to improve educational outcomes across all socioeconomic backgrounds and ensure foundational readiness of students. The Government will also strive to improve core education support to close achievement gaps, particularly among the unserved and underserved communities. Budget 2026 also seeks to sustain the momentum in STEM, TVET and lifelong learning pathways, aligned with national workforce strategies and the future of high-growth sectors.

Bridging the Urban-Rural Divide

As with previous MADANI Budgets, Budget 2026 continues the Government’s push to bridge the urban-rural divide and modernise regional development — including in remote and underserved areas of Sabah and Sarawak. Core investments will focus on essential infrastructure and utilities, including roads, treated water, electricity, sewerage and high-speed internet.

These basic necessities are fundamental to a dignified standard of living — and giving every Malaysian a fair start to upward social mobility.

Empowering All to Participate in a Growing Economy

Budget 2026 strengthens the Government’s commitment to inclusive growth, ensuring that all Malaysians, across diverse identities and life stages, have fair access to opportunity. The table below outlines targeted empowerment strategies tailored to key groups.

| Target Group | Key Initiatives / Interventions |

|---|---|

| Youth | Expansion of TVET programmes, support for social enterprises, access to financing and digital platforms |

| Women | Investment in childcare infrastructure, flexible work arrangements, up- skilling and entrepreneurship programmes |

| Senior Citizens | Strengthened social protection systems, expanded geriatric and home-based care, sustainable funding of elderly care |

| Persons with Disabilities (PWDs) | Inclusive education access, barrier-free public infrastructure and digital services, inclusive employment frameworks |

| Indigenous Communities | Improved basic infrastructure, health and education access community-driven economic development initiatives |

| Bumiputera | Strengthened focus towards the 3P strategy—broader participation, meaningful ownership, and effective control in strategic sectors. |

These interventions reinforce Malaysia’s belief that equitable development is not only morally right — it is economically essential. By investing in youth, women, the elderly, PWDs and indigenous communities, the nation builds capacity, fosters dignity and ensures no one is left behind as Malaysia progresses.

4. CONCLUSION

Reforms cannot be completed overnight. For the fourth year running, the MADANI Budget continues the Government’s agenda to correct the structural impediments that have long held Malaysia back from realising its full potential. The nation is blessed with abundant resources, a strategic location between East and West and a rich diversity of cultures that adds depth and colour to our shared life. Unity in diversity, grounded in mutual understanding and social cohesion are not only central to our national identity but also a key foundation for sustainable and inclusive development.

Ekonomi MADANI is designed to unlock this latent potential through clear policies that advance both economic development and the rakyat’s living standards. Budget 2026 marks another step toward realising this long-term vision.

The Government is scheduled to table Budget 2026 to the Parliament on 10 October 2025 and the Ministry of Finance will be coordinating extensive public and stakeholder engagements to secure inputs, in line with the above-mentioned priorities in Ekonomi MADANI. The Government is committed to translate the inputs received from these engagements into Budget 2026, especially those that directly support the advancement of economy, well-being of the rakyat and better governance. Comments, feedback and proposals on Budget 2026 can be channelled through the Belanjawan 2026 portal at https://belanjawan.mof.gov.my.

Ministry of Finance

8 August 2025

↓ Download: Pre-Budget-Statement-2026