WHAT ARE YOU LOOKING FOR?

Popular Tags

Press Release

Service Tax Exemptions For The Logistics Sector And Maintenance Services

The Ministry of Finance has refined the scope for Service Tax exemptions with the objective of alleviating the direct impact on the rakyat’s living cost and cascading tax incidences in the logistics sector.

“The Service Tax exemptions for the logistics sector and maintenance services are provided as the Government aims to mitigate the tax’s effect on the rakyat’s cost of living, and at the same time, maintain the competitiveness of the nation’s services sector. To further preserve the country’s competitiveness, the Government will also not impose Service Tax in free zones,” explained YB Senator Datuk Seri Amir Hamzah Azizan, Finance Minister II.

Additional Service Tax exemption scope for the logistics sector

In order to ease the tax impact on daily logistics operating activities, and ultimately the consumers, the Government has agreed on the following:

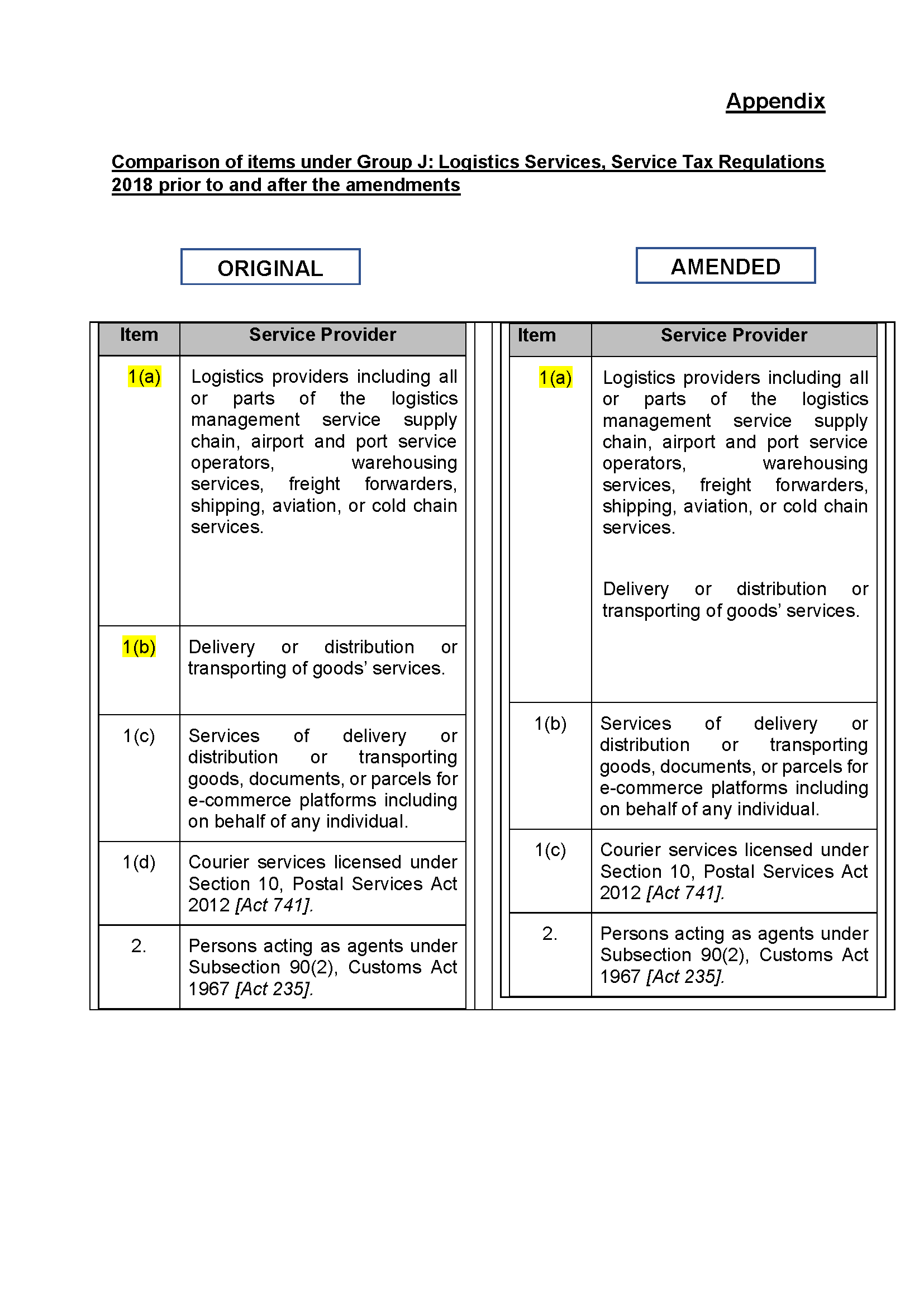

- Amendments to Group J: Logistics Services in First Schedule, Service Tax Regulations 2018, whereby Item 1(a) in relation to logistics services, and Item 1(b) pertaining to delivery or distribution or transporting services have been merged into a single item.

By combining the two items into one, the exemption scope for business-to- business activities has been widened whereby logistics service providers classified under Item 1(a) are now no longer required to incur Service Tax for acquiring delivery or distribution or transporting services that previously had been listed under Item 1(b).

Prior to this amendment, logistics service providers under Item 1(a) were entitled to tax exemptions for acquiring services under the same item only. Please refer to the appendix for the amendments to items under Group J: Logistics Services. - All services under Group J: Logistics Services provided in or between Special Area/Designated Area, between Special Area and Designated Area, or vice versa are not subject to Service Tax except for Customs Agent services which remains taxable for Service Tax. With that, Free Commercial Zones and Free Industrial Zones such as the Port Klang Free Zone and West Port in Selangor, as well as the Pasir Gudang Port in Johor, shall benefit from this exemption.

- Exemption for ocean freight charges for all goods delivered by sea mode, limited to these routes/destinations:

- Peninsular Malaysia to Sabah/Sarawak/Labuan;

- Sabah/Sarawak/Labuan to Peninsular Malaysia; and

- Between Sabah, Sarawak, and Labuan.

These enhancements are additions to the widening of Service Tax exemption scope for logistics sectors as announced on 11 March 2024.

Additional Service Tax exemption scope for maintenance services

The Government has also agreed to provide Service Tax exemptions for maintenance services for these items:

- Repairs of residential buildings;;

- Sinking funds; and

- Maintenance services related to land or buildings for residential purposes provided by developers, joint management bodies, or resident associations.

With this, all maintenance and repair services at residential premises such as roof upgrades or for any item and fixture attached to or part of the residential premise’s structure such as lifts, air conditioners, and water heaters are not subject to Service Tax.

The Service Tax rate’s increase from 6% to 8% that came into effect on 1 March 2024 is concentrated on services that are discretionary in nature and business-to-business activities that do not directly impact the rakyat. The increase does not involve key essential services that are part and parcel of the rakyat’s lifestyle such as food and beverage, telecommunications, and vehicle parking.

Ministry of Finance

Putrajaya

31 March 2024