WHAT ARE YOU LOOKING FOR?

Popular Tags

Press Release

Strong Economic Fundamentals and Prudent Management Contribute to The Strengthening of The Ringgit

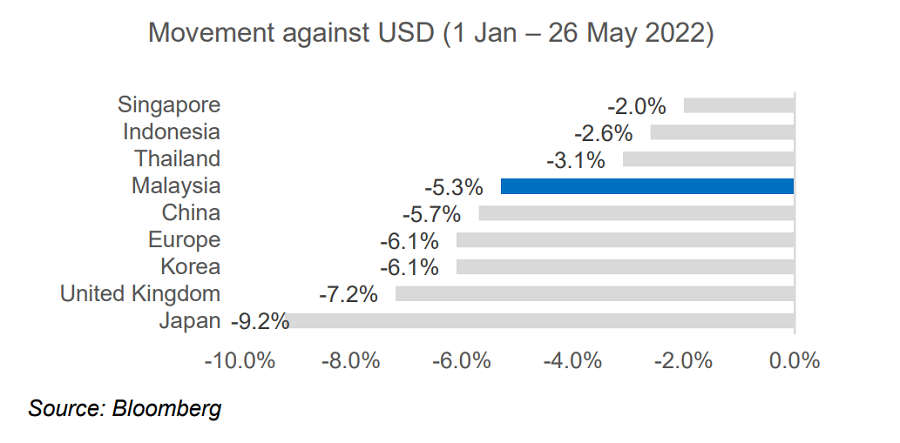

Strong economic fundamentals and prudent ringgit management are expected to contribute to the strengthening of the ringgit against the US dollar (USD), despite several temporary factors that have contributed to the Ringgit's current depreciation.

These factors include:

- Expectations on the global monetary policy situation, as well as the continued tightening of global liquidity, have alarmed the international investor community. As a result, they have reallocated funds to higher-yielding assets denominated in USD. This has led to the depreciation of various global currencies, including the Ringgit1;

- Due to movement restrictions in major cities, China's growth prospects are expected to deteriorate this year, which have weakened the Yuan. Moreover, the International Monetary Fund (IMF) has lowered their forecast for China to 4.4% (2021: 8.1%). This has an impact on the Ringgit because Malaysia-China trade volume is significant, with exports

1

to China accounting for 10.7% of GDP (compared to 2.1% in Indonesia and 1.3% in Thailand); and

(3) The volatile situation of global geopolitical tensions has put pressure on global economies. This is reflected in the value of the VIX, or the investor "fear index," which increased to 25.7 points (May 29, 2022) from the previous average of 18 points. This has also caused investors to flock to "safe-haven assets" (such as gold and the US dollar), putting downward pressure on various currencies, including the ringgit.

However, all of these factors are regarded as temporary. Based on current factors, the ringgit's value is expected to remain stable and strengthen as:

- BNM actively manages the ringgit to ensure that fluctuations are orderly and not excessive, allowing the economic sector to make investment and expenditure plans based on a more stable value of the ringgit.

- What is more important are our economy's strong fundamentals, such as the country's continued economic growth prospects. The ringgit will continue to strengthen as the economy expands by 3.6% in the fourth quarter of 2021, and 5.0% in the first quarter of 2022. This is also reflected in the most recent IMF analysis, which projects 5.75% GDP growth for Malaysia in 2022, driven by pent-up domestic demand and continued strong external demand. At the same time, the expectation of a current account surplus means that demand for the ringgit will remain strong.

- Analysts remains optimistic about the prospects for a strong recovery of the ringgit in the near future. This is illustrated by their median and average projections as follows:

| 2nd Quarter 2022 (Q2 22)) | 3rd Quarter 2022 (Q3 22) | 4th Quarter 2022 (Q4 22) | 1st Quarter 2023 (Q1 23 | |

| Overall Median | 4.37 | 4.35 | 4.28 | 4.27 |

| Overall Average | 4.35 | 4.37 | 4.29 | 4.25 |

| Firm | Forecast Date (2022) | Q2 22 | Q3 22 | Q4 22 | Q1 23 |

| Raboban | 23 May/td> | 4.02 | -- | 3.98 | -- |

| Credit Agricole CIB | 19 May | 4.45 | 4.50 | 4.35 | 4.30 |

| Standard Chartered | 17 May | 4.40 | 4.35 | 4.25 | 4.15 |

| Westpac Banking | 17 May | 4.35 | 4.30 | 4.20 | 4.15 |

| Ebury | 16 May | 4.30 | 4.25 | 4.20 | 4.44 |

| JPMorgan Chase | 16 May | 4.40 | 4.42 | 4.44 | 4.17 |

| Mizuho Bank | 12 May | 4.38 | 4.33 | 4.22 | -- |

| Nomura Bank International | 12 May | 4.43 | 4.35 | 4.28 | 4.28 |

| Morgan Stanley | 11 May | 4.40 | 4.50 | 4.30 | 4.28 |

| MUFG | 5 May | 4.35 | 4.33 | 4.30 | 4.28 |

| RBC Capital Markets | 5 May | 4.35 | 4.40 | 4.40 | 4.30 |

Sumber: Bloomberg Poll

Moving forward, the MOF is optimistic about the country's economic growth prospects. Malaysia's GDP is expected to grow between 5.3 and 6.3% in 2022, contributing to the ringgit's stability. The MOF and Bank Negara Malaysia (BNM) will continue to monitor both financial and non-financial risks to the national economy in order to maintain economic stability and the well-being of all Malaysians.

YB Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz

Minister of Finance Malaysia

Putrajaya

28 May 2022